TL;DR — AR Analitycs

Physical stores lack the data tracking available online—in-store behavior has been invisible. AR analytics reveal real-time customer behavior: what shoppers try on, what grabs their attention, and how different audiences engage across locations.

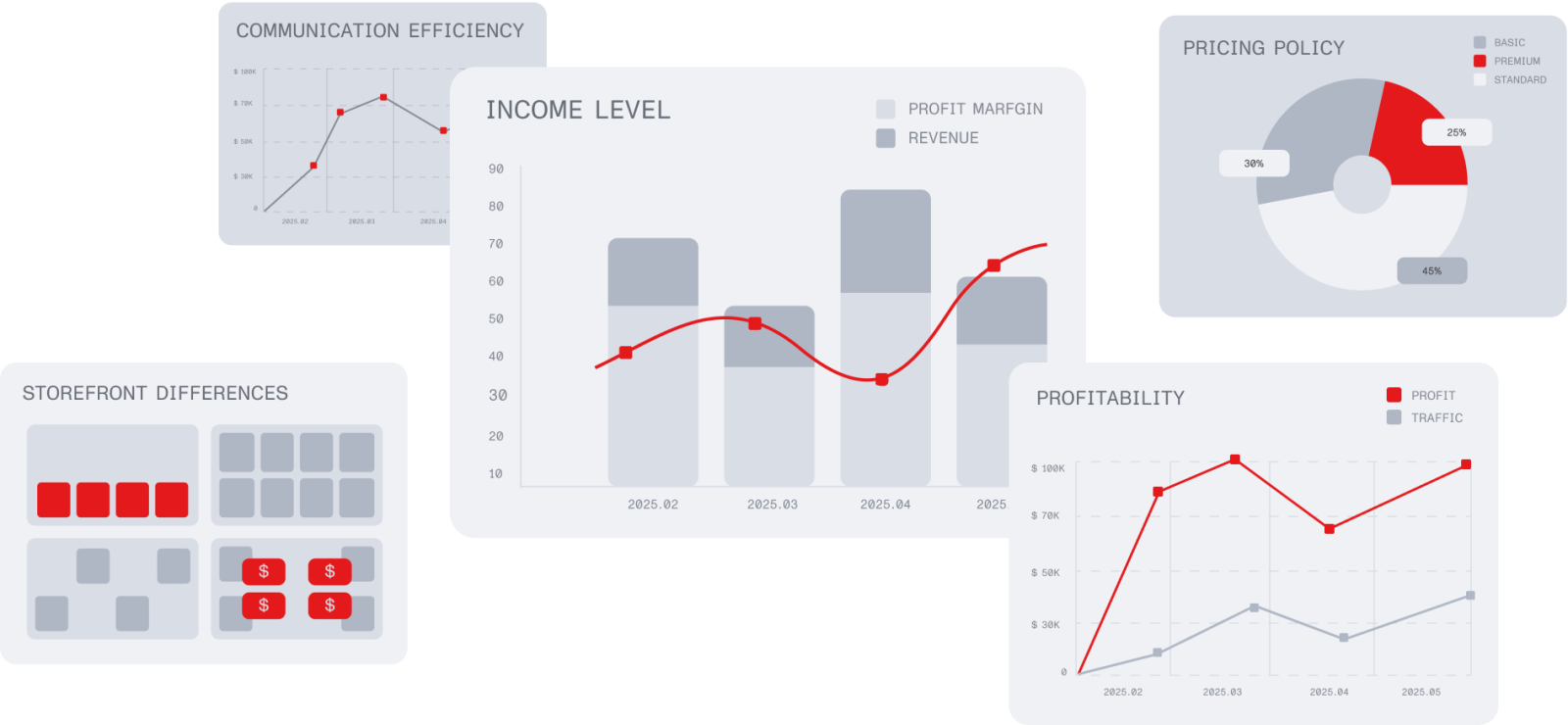

Two Data Layers:

- AR Interaction Analytics: Tracks engagement, dwell time, and product exploration without collecting personal data.

- AI Demographic Insights: Reveals anonymized age, gender, and style signals to show who is engaging.

AR and AI analytics enable retailers to tailor inventory, personalize messaging, optimize by location, reduce inventory risk, and connect online-offline journeys with e-commerce precision. Every in-store interaction becomes measurable and actionable.

What Is Augmented Reality Analytics?

Augmented reality analytics is the process of measuring how people interact with an AR experience and what outcomes it drives for your business. It goes beyond basic views to track signals like activations, dwell time, interaction depth, and which products or effects users try most—plus conversion actions such as QR scans, clicks, leads, or purchases when integrations are available. In short, AR analytics turns AR from a “wow” moment into a measurable channel you can optimize, prove ROI for, and scale with confidence.

The Two Layers of AI/AR In-Store Analytics

AR and AI analytics work together by merging two powerful data streams into one clear picture of in-store behaviour. AR reveals what customers do, AI uncovers who they are, and together they explain why—giving retailers the targeted, performance-focused intelligence that makes true phygital decision-making possible on the store floor.

AR Interaction Analytics (No Personal Data)

The first layer of AR/AI analytics is entirely privacy-safe, yet incredibly powerful. It captures how shoppers interact with the AR Mirror in real time—how many people engage, whether they explore alone or in groups, how long they stay, and which paths they take through the experience. When multiple virtual try-ons or product options are available, this layer reveals product-level behaviour as well: which items pull the most attention, which ones are skipped, and which looks users come back to repeatedly.

This gives retailers a live read on product appeal that feels very similar to e-commerce analytics, but happening right on the store floor. For example, if an eyewear brand notices that shoppers spend twice as long interacting with a new frame style compared to the existing collection, it becomes an immediate cue to increase inventory and position the product more prominently. Interaction analytics show what people are genuinely drawn to—no personal data required—turning everyday browsing moments into actionable insights.

AI-Powered Demographic and Behavioural Insights (With Consent)

When shoppers opt in with a quick gesture, the AR/AI system unlocks a deeper layer of analytics that adds anonymized demographic and style signals to the picture. With this consent, AI can estimate attributes such as age range, gender, skin tone, hair type, facial structure, and even clothing style cues. These insights help retailers understand who is engaging with each touchpoint and how audience profiles shift by location, time of day, or campaign moment.

Once this layer is activated, retailers can localize assortments, tailor their messaging, adjust store layouts, and refine promotions to match the specific audience standing in front of them—not a theoretical persona. For example, if a skincare brand discovers that most AR Mirror users in Airport A are men aged 25–35, it can immediately spotlight men’s travel-friendly skincare kits on-screen and at the point of sale. With consent-driven insights, every store becomes more relevant, more responsive, and more aligned with the real people walking through it.

The Power of Combining Both Analytics Layers

When the two layers of AR and AI analytics come together, they create one of the most advanced insight engines available in physical retail—a system that delivers e-commerce-level precision while still respecting user privacy. AR interaction data shows what shoppers do; consent-based AI reveals who is engaging; and together they unlock a clear, actionable understanding of why certain products and experiences resonate.

By merging anonymous behavioural patterns with demographic signals, retailers gain:

- Product preference mapping: a clear view of which audience segments are drawn to specific items or looks.

- Emotional and engagement analysis: visibility into how long different groups interact with products and which experiences generate excitement, hesitation, or early drop-off.

- Audience–product correlation: insights like “Women 18–25 prefer matte lipsticks,” “Men 30–40 spend the longest exploring skincare diagnostics,” or “Tourists engage more with photobooth-style effects.”

- Localized customer intelligence: the ability to tailor inventory, campaigns, and content per store based on real, location-specific audience behaviour rather than assumptions.

For example, if a retail chain discovers that a particular product performs strongly only in city-center stores, it can immediately adjust its omnichannel campaign to focus on those high-potential areas.

Together, these layers turn the store floor into a measurable, optimized environment where every interaction becomes a data point—and offline retail finally shifts from broad, generic communication to precision-targeted, performance-driven engagement worthy of the phygital era.

Key Metrics for Different AR Mirror Use Cases

Different AR Mirror use cases require different analytics. Below are the key metrics for each, so you can measure real impact and optimize ROI.

- Foot traffic detected (passersby)

- Activation rate (engaged users / passersby)

- Engagement rate (interactions / engaged users)

- Dwell time (average session duration)

- Try-on volume (total tries per product/category)

- Product interest ranking (most tried items/looks)

- Completion rate (reached photo/CTA step)

- Conversion actions (QR scans, clicks, leads, coupon redemptions)

- Repeat usage (returning users / sessions per user)

AR Storefronts

AR storefronts turn traditional windows into active, attention-grabbing discovery moments that guide passersby directly toward promoted products. When positioned in malls, high-street locations, or travel retail, the creative must instantly capture attention and connect clearly with what shoppers will find inside. When executed well, AR storefronts can lift foot traffic by up to 20% and significantly increase product engagement.

The strongest indicators of performance include changes in foot traffic before and after installation, the rate at which passersby convert into store visitors, the amount of time people spend interacting with the experience, and how often featured items are explored through the AR interface. Retailers also track the corresponding sales uplift, especially for highlighted products. Because these mirrors amplify existing demand, they deliver the biggest impact in locations that already benefit from steady foot traffic.

Kiehl’s AR Storefront with real-time skin analysis generated 3,118 interactions, about 17 activations per hour, and drove a 20% increase in foot traffic, proving AR’s impact on in-store performance.

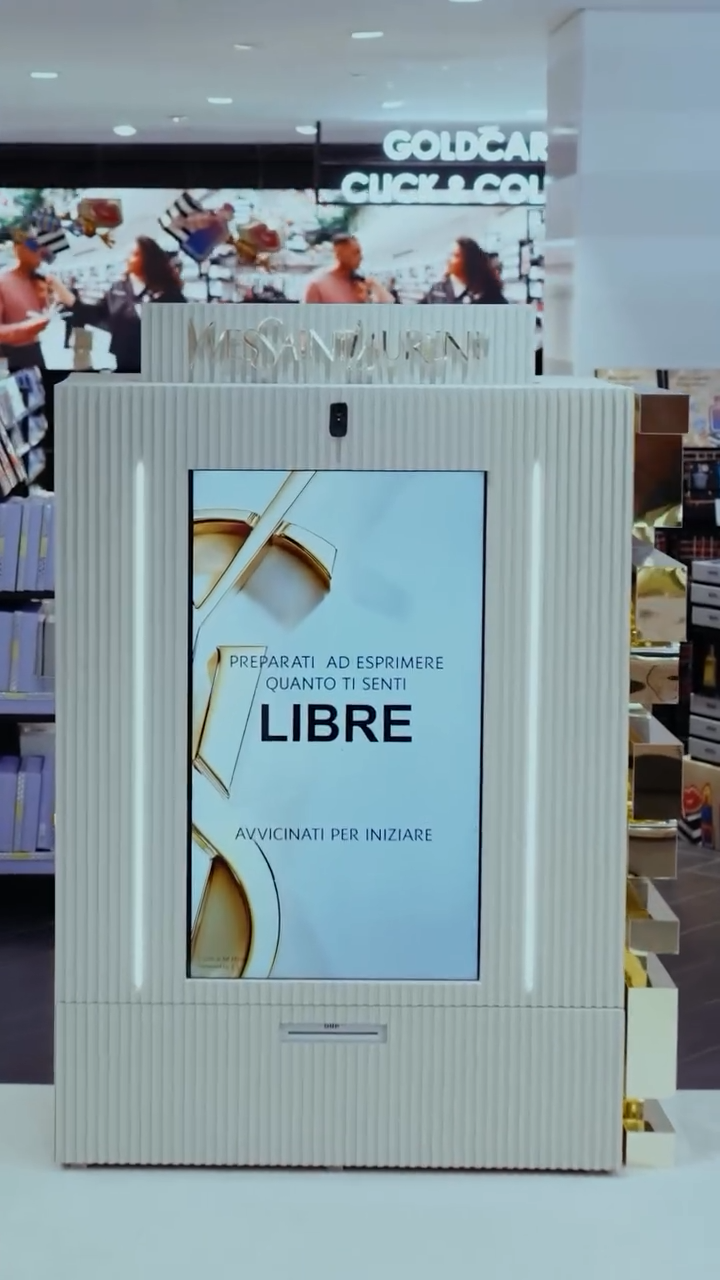

AR Photobooths and Sampling

At events, pop-ups, and influencer activations, AR photobooths focus on emotional engagement and social reach rather than direct sales. They offer highly photogenic, shareable experiences that visitors instinctively record and post online. In premium setups, the mirror can also act as a virtual vending machine, distributing product samples and strengthening visitors’ emotional connection with the brand.

Performance is measured by tracking how many people activate the experience, how long they interact, how much content they capture, and how widely that content spreads on social platforms. High-traffic events typically generate around one activation per minute, resulting in approximately 720 interactions over a two-day activation window. Once multiplied by the average follower count of event attendees, this creates significant awareness.

YSL’s AR Photobooth invited shoppers to strike bold poses and create shareable branded collages, generating over 3,000 activations and significantly boosting engagement for the Libre fragrance launch.

In-Store AR Mirrors

In-store retail smart mirrors enhance retail spaces by encouraging deeper exploration and reducing friction in the shopping journey. Visitors can instantly try on full product catalogs, experiment with different colors and styles, and discover options that may not be physically available on the floor. This leads to longer, more meaningful engagement and more opportunities for cross-selling and upselling.

Key performance indicators include the number of products virtually tried on during each session, the rate at which try-ons translate into purchases, the extent to which customers explore additional categories, and the sales uplift following mirror installation. Retailers often see significant results, with some locations achieving up to 40% year-over-year sales growth after implementing this technology.

Fendi’s AR Mirror at Istanbul Airport let travelers virtually try on sunglasses and print branded photos, helping the collection sell out and boosting sales by 43% year over year.

AR OOH Billboards

AR-enabled outdoor billboards create large-scale awareness by letting people see themselves live on massive screens. This triggers an immediate desire to interact, record the moment, and share it across social channels, while also drawing the attention of bystanders who witness the activation from the street.

Performance measurement focuses on three layers: direct interactions with the AR system, the volume of visual impressions generated by bystanders and passing traffic, and the spread of user-generated content across social media. When placed near retail points where the featured product is sold, these billboards can also influence in-store sales by connecting emotional engagement with real-world purchase opportunities.

Pepsi’s activation, for example, recorded more than 1,000 direct interactions in a single day, with exponentially more impressions driven by spectators and drivers.

How Retailers Can Use AR/AI Analytics to Make Better Decisions

AR/AI analytics give retailers a clear, side-by-side view of how different audience groups behave across every store in their network. By capturing anonymized demographic cues such as age range, gender, style signals, and engagement patterns, brands can see which locations attract younger shoppers, which ones appeal to premium audiences, and how product interest shifts between city centres, malls, and travel-retail environments. This creates a real-time behavioural map of the entire retail ecosystem, helping retailers pinpoint high-performing touchpoints, understand regional nuances, and fine-tune each location’s strategy based on the real people walking through the door.

Once retailers know who their audiences are and what they gravitate toward, decision-making becomes dramatically more precise. Product assortments can be tailored to local tastes, pricing strategies can be adjusted to match demographic expectations, and campaign messaging can be refined to resonate with specific shopper groups. Younger, trend-driven audiences might see bold seasonal launches, while more premium or mature locations can highlight classic and higher-value products. Every touchpoint becomes more relevant because it reflects actual behaviour—not assumptions.

AR/AI analytics also play a major role in reducing inventory risk. By tracking which products each demographic interacts with most—and how these preferences evolve over time—retailers can forecast demand with far greater accuracy. Real-time signals like dwell time, repeated selections, and virtual try-on frequency reveal true product interest, enabling smarter allocation, fewer stockouts, less over-ordering, and more confident planning. Inventory decisions shift from reactive to predictive.

These insights extend beyond operations and directly strengthen the omnichannel journey. When in-store behaviour is connected with broader digital patterns, customers can discover a product through an AI Mirror, continue exploring it online, and receive personalized recommendations based on aggregated engagement data. Retailers can identify friction points—such as products that attract high AR engagement but low purchase conversion—and improve both physical and digital experiences accordingly. The result is a more seamless, intelligent retail journey where every channel feels connected, intentional, and deeply informed by real behaviour.

Conclusion

AR and AI analytics are transforming physical retail from a space of guesswork into one of precision and performance. By revealing who visits each location, what captures their attention, and how they interact with products, these technologies give retailers the same clarity and control they’ve long enjoyed online—now applied directly to the store floor. The result is a truly phygital environment where every interaction becomes measurable, every decision becomes smarter, and every customer experience becomes more relevant.

For brands ready to move beyond assumptions and into real-time, actionable intelligence, AR Mirrors offer more than engagement—they deliver the insights needed to optimize inventory, personalize messaging, and connect online and offline journeys with confidence. The future of retail isn’t about choosing between digital and physical. It’s about making both work together, powered by the data that brings them into focus.

Explore our latest posts:

- How AI & AR Analytics Bridges the Gap Between Online and Offline Retail

- Retailtainment: What It Means for Modern Retail (With Examples)

- AI-Driven OOH: Turning Physical Screens Into Intelligent Media Channels

- Interactive Out-of-Home Advertising: The Future of Public Brand Engagement

- The Business Impact of Immersive Shopping Experiences